How is the economy doing?

Banks are expert at managing risks.

When the economy is doing well, banks will lend more money to businesses and consumers.

When the economy is slowing down, banks will tighten their lending standards to avoid bad loans.

So, how is the economy doing as of January 30, 2026?

Excellent.

When the economy is doing well, banks can lend more money and earn more interest income.

When the economy is slowing down, banks will have to set aside more money for bad loans, which will reduce their profits.

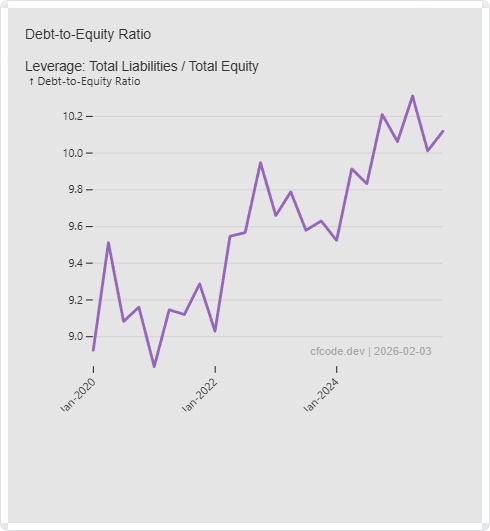

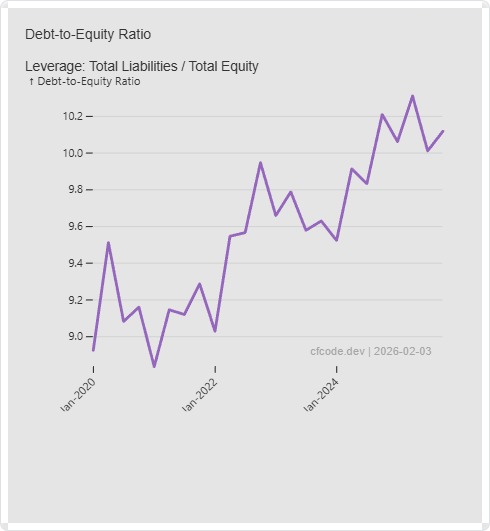

Here is a chart showing the Debt-to-Equity (D/E) ratio for Maybank.

As of 30 September 2025, Maybank’s D/E ratio is 10.12 times. This means Maybank is taking maximum advantage of leverage to grow its business.

During the Covid years, the D/E ratio went as low as 8.84 times in the quarter ending December-2020.

Different bank have different D/E ratios depending on their business models.

Public Bank, for example, has a D/E ratio of only 8.18 times as of 30 September 2025.

You can take a look at the rest of the banks’ financial health via the dashboard here.

Data is updated quarterly based on banks’ financial results announcements.